Recent

Rental Revenue Remains Strong Going into 2018, Baird/RER Survey Shows

Rental revenue has been steadily improving during the past two years and 2018 growth in expected to remain robust, according to a survey of RER’s readers conducted by Baird Associates along with Rental Equipment Register. The average fourth quarter rental revenue growth of 9.4 percent year over year was higher than the third quarter’s revenue growth of 6 year over year, and was similar to the second quarter’s year-over-year revenue growth of 9.6 percent, which was the strongest growth since 2015. After declining from 10.6 percent in the second quarter to 4.1 percent in the fourth quarter of 2015 because of commodity-related weakness.

Anecdotal commentary suggested general strength in residential and non-residential (commercial) construction, along with oil-and-gas improvement.

Respondents expect revenue to increase 7.7 percent in 2018.

“Nonresidential construction remains strong,” said one respondent. “Customer optimism is very high. 2018 looks very strong on the surface, most likely spilling well into 2019.”

“Overall, we are seeing an increase in construction activity in all areas; energy, industrial, infrastructure, residential, and commercial construction,” added another.

“In the oilfield, we’re seeing pretty significant growth for Q1-Q2,” said a third.

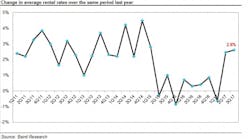

Average rental rates growth was up 2.1 percent year over year, according to the survey, similar to two previous quarters. Many respondents highlighted pricing competition, but pricing pressures appears to be alleviating as demand improve. And respondents expect rate growth to improve in 2018 by 3.5 percent, which is some of the strongest growth since 2014.

Fleet utilization was the highest in the history of the survey, at 64.9 percent, compared to 62.7 percent last quarter and 58.7 percent in the fourth quarter of 2016. Baird believes recent strong utilization rates are a sign of solid end-market dynamics and are directionally consistent with United Rentals’ recently disclosed time utilization rates, which were 71.9 percent in the third quarter, 69.4 percent in the second quarter and 66 percent in the first quarter all records for those particular quarters.

More challenging for respondents was the cost of new equipment, which they said increased 3.7 percent, higher than the third quarter’s 2.9-percent gain and slightly above recent history of new unit cost growth in the low-single-digit range, recalling multiple OEM price increases discussed towards the end of 2017.

Average fleet size in numbers of units grew 5.2 percent year over year in the fourth quarter, down from the previous quarter’s growth of 8.9 percent, strongest growth in the survey’s history. Baird suggests that some equipment purchases may have been delayed until 2018 as buyers looked for clarity on new tax legislation. Respondents expect a 7.4-percent increase in fleet purchases in 2018, with both earthmoving equipment and access equipment spending are expected to increase 7 percent.

For more information go to www.rwbaird.com