Rental Industry Forecast to Surpass $32 Billion in 2013

For many industries and individuals, the economy of the past several years has been devastating. These are facts to which no one is immune. Consumed by the uncertainty of both the United States and other global economies, many industries have suffered crippling financial losses and as a result millions of workers have lost their jobs.

All this tumult and insecurity, however, has led to very positive revenue and utilization growth for the equipment rental industry, corresponding with recent Baird/RER equipment rental surveys, which showed four consecutive quarters of double-digit growth followed by slightly more moderate single-digit growth in the most recent quarter surveyed. More contractors and homeowners are turning to equipment rental to supplement their equipment needs instead of investing their dollars into new equipment and fleet purchases — a veritable boon for the rental industry.

Hitting a sweet spot in 2011, as reported in my 2012 rental industry forecast in RER magazine in February 2012, the equipment rental business maintained its hold on that sweet spot well into 2012 and, in our opinion, the market will benefit from a number of tailwinds allowing it to continue growing at double-digit rates into 2014 and perhaps beyond. Overall, we are forecasting that 2013 U.S. rental of construction equipment will increase 16 percent to more than $32 billion.

The Growth of Construction Equipment Rental

The economic uncertainty that has prevailed for several years has actually been a big benefit for the rental industry. Equipment users facing an uncertain future have turned to renting as a way to conserve cash. Renting is also an alternative for users who may be unable to obtain equipment purchase financing. The case for rentals is still strongest for equipment users that are utilizing their machines 50 percent of the time or less. Anyone who has a need for a production machine that is a primary tool in their fleet would be better off purchasing it.

EPA emission regulations that began Jan. 1, 2012 have also benefitted equipment rentals. The regulations require many new machines built after Jan. 1, 2012 to be equipped with Tier 4 interim engines. Machines equipped with Tier 4 interim engines are considerably more expensive than machines with Tier 3 engines. Uncertainties remain regarding the operating performance of these units. Preliminary indications are that the new engines are more expensive to operate as well. The higher operating cost indications are based on the experience of on-highway truck users who have been operating Tier 4 engines since 2010. The higher machine purchase price and possibly uncertain operating performance also have caused uncertainty over the future residual values of new machines, which is another factor that has driven users to favor rentals.

Recent data indicates that 52 percent of all new machines sold are going into the rental fleets of national rental companies, authorized dealer rental fleets and rental fleets owned by independents.

Traditionally the rental industry's fortunes have closely followed construction employment. However, after reviewing recent data it appears the close correlation between employment and rental revenues did not exist in 2012. We attribute the lack of correlation to economic uncertainty, which is hard to measure and put on a graph.

Our forecast for the economy as a whole is for slow growth. The 2013 market will benefit from an improving housing market, continued high levels of demand from the energy sector and improving non-residential construction investment by manufacturers. Overall we expect 2013 growth of equipment sales to be approximately 5.4 percent compared with 2012. We expect the sales slowdown that began in the second half of 2012 to extend into the first half of 2013, with most 2013 growth occurring in the second half. Assumptions for the construction sector are illustrated in the chart titled: “Value of Construction Put in Place.”

Value of Construction Put in Place

(Millions of dollars)

The national rental companies had a great year in 2012. Revenues grew in a range from 8 to 38 percent with an average of approximately 12 percent.

Rental revenue growth has been driven by supply and demand. Fleet utilization rates (based on time) were the highest they have been since 2008, which has allowed companies to aggressively increase their rates.

Rental companies have been hard pressed to keep up with the growth of the market. As a result we saw massive capital expenditures in both of the past two years. Most companies said they will continue adding to their fleets in 2013, however, the mix will be different. In 2011 and 2012 rental companies anticipated that demand for earthmoving equipment would come back before demand for aerials and lifting equipment. In both years rental companies changed the mix of their fleets toward earthmoving and away from aerial work platforms and other lifting equipment. Billions were spent, which greatly benefited the equipment manufacturers.

Rental company profits have benefited from the perfect storm of rising demand for rental and increased rental rates and higher fleet utilization. These factors have allowed them to make huge investments in new fleet, which lowered their operating cost and increased their margins.

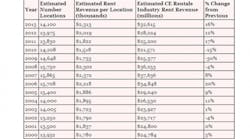

The U.S. rental market for construction equipment reached approximately $28 billion in 2012. Based on underlying market trends, we believe the total market will grow to more than $32 billion in 2013. That forecast is based on our estimate that there will be approximately 14,000 rental locations in 2013 and the average revenues per location will be slightly more than $2.3 million. Of note is the probability that United Rentals will close nearly 200 locations this year as it rationalizes locations obtained in its merger with RSC. In addition, Ahern Rentals, which is fighting for survival (see story on page 12), may be forced to close some branch operations pending resolution of its Chapter 11 bankruptcy case. Significant growth among independent rental companies, however, we believe will cause the absolute number of branches to increase by a little more than 100 locations. While the absolute quantity of locations remains relatively constant, the revenues generated per location continue to increase.

Ebitda Margin

Nine months ended Sept. 30

*Sunbelt first quarter ended July 31

Overall, we are forecasting that 2013 U.S. rental of construction equipment will increase 16 percent to more than $32 billion.

Frank Manfredi is president of Mandelein , Ill.-based Manfredi & Associates, a marketing information firm that specializes in the construction, mining, farm and material-handling equipment industries. Visit www.machineryoutlook.com.