Baird/RER Survey: Rental Revenue Growth Continues Strong Upswing in Second Quarter

Baird, in partnership with RER, recently published the results of its second-quarter 2012 rental equipment industry survey, showing continued double-digit rental revenue growth of 10.4 percent year over year, compared with 10.5-percent growth in the first quarter of 2012. The most recent Baird/RER survey marks the fourth consecutive quarter of double-digit rental revenue growth. Rental revenue last saw single-digit growth in the second-quarter of 2011 when the increase dipped to 9.3-percent growth from the 13.5-percent increase recorded in the previous 1Q11 quarter.

While rental revenue trends remain varied based on geography and end market, overall trends show continued improvement. Outlook for the remainder of this year reflects expectations for sustained solid growth with pricing trends to remain positive throughout 2012.

“[There is] increased demand for earthmoving and aerial platforms, driven by public works and alternative energy,” one respondent noted. “There are pockets of intense activity,” said another. “The rebound is still slow in others. Increased operational capabilities have paid dividends in spite of increased competition.”

Rental rates showed slight growth in the second quarter, up 1.7 percent year over year, but down from the 3-percent growth reported in the first quarter of 2012. Strong underlying demand continues to push rental rates higher, but against increasingly difficult prior-year comparisons, the Baird/RER survey reports.

“Business activity and rental rates have improved significantly and are expected to hold strong in our area through 2012,” a respondent said. “Discounting is still heavy, but some of the nationals are starting to bring rates up a little,” another noted.

“There is a lot of pricing pressure on equipment bidding, making it difficult to increase rental rates further at the moment,” said a third.

On average, time utilization improved in the quarter to 58.9 percent compared to 53.6 percent in the first quarter of the year, a 9.9-percent increase and consistent with seasonal trends. Average utilization for Big Iron equipment was 61.1 percent, while Small Iron was 58.5 percent and Other was 52.5 percent in the quarter. High utilization rates appear to reflect solid underlying demand and some lingering fleet availability issues, the Baird/RER survey reported.

“We are definitely seeing increases in utilization,” a respondent said. “With everyone having reduced their fleets, we are seeing maximum utilization rates.” Another survey participant said, “National players are using consolidation and entry into specialty markets as a means to improve utilization performance.”

Respondents were not without concerns. “There is very slow improvement in utilization and rates,” noted another. “The industry still has too much of some inventory.”

In the second quarter, respondents reported that the number of items in their rental fleet increased by 6.8 percent year over year, a slight increase from the 6.3-percent improvement reported in the first quarter. Respondents reported that they expect to spend 6.2-percent more on fleet expansion over the next six months, a slight decrease from the 9.2-percent fleet-spending expectation reported in the first quarter.

Respondents expressed less optimism in viewing the whole year’s prospects. In the revised outlook for 2012 revenue growth, respondents forecast 8.5-percent year-over-year growth, moderating from the previous outlook of 12.2 percent year over year predicted in the first quarter of 2012. The revised outlook on rental rates showed respondents expect a 3.6-percent increase, implying a solid improvement over the current-quarter levels of 1.7-percent growth.

“While the economy still struggles to get back on its feet entirely, we do feel that the rental industry is gaining,” one respondent said reflecting on the positive outlook for the remainder of the year. “We foresee a positive outcome on our rates/sales.”

Reflecting the varied outlook by geography and end market, another respondent had a different perspective: “The growth rate has slowed. We are still growing, but the comparable months in 2011 were much higher revenue than the beginning of the year.” Another respondent had a more moderate comment: “There is still a lot of uncertainty in the market, as it appears a lot of industrial jobs are still in limbo. We are expecting flat revenues over the remaining part of 2012.”

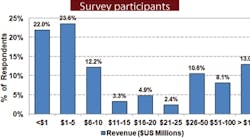

Participants in the Baird/RER survey are senior executives or senior managers at regional divisions of rental equipment businesses in all regions of the United States, parts of Canada and some international markets, representing nearly $8 billion in annual revenue.

Robert W. Baird & Co. is an employee-owned, international wealth management, capital markets, private equity and asset management firm with offices in the United States, Europe and Asia. For more information, visit Baird’s website at rwbaird.com.

RER has covered the equipment rental industry since 1957, providing its readers with a mix of news, features and product information. For more information, visit www.rermag.com. To let us know about any additional information you would like measured by the Baird/RER survey, post your comments on our Facebook at http://www.facebook.com/rentalequipmentregister or email Brandey Smith at [email protected]. rer