Order Intake Grows While Net Sales Decline for Volvo CE in Third Quarter

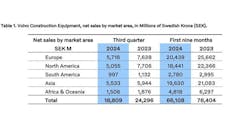

Volvo Construction Equipment posted SEK 18,809 million in revenue in the third quarter of 2024 compared to SEK 24,296 million in the third quarter of 2023, a 22.6 decline. North America net sales dropped from SEK 7,706 million to SEK 5,055 million, a 34.4-percent decline. Net sales in Europe declined from SEK 7,638 million to 5,718 million a 25.1-percent drop.

The decline in net sales in Asia was not as steep, from SEK 5,944 million to SEK 5,533 billion, a 6.9-percent tumble. In South America, the decline was from SEK 1,132 million to SEK 997 million, an 11.9-percent skid, while Africa and Oceania decreased from SEK 1,876 million to SEK 1,506 million, a 19.7-percent dip.

Lower volumes in Europe and North America for the third quarter – when compared to the very high levels of last year – have caused a drop in overall net sales for Volvo CE. However, it has maintained overall good margins despite this slower demand and has overseen a growth in the China market.

However, net order intake has risen slightly, caused largely by a 59-percent increase in South America and a 44-percent increase in Europe, strengthened also by a more modest rise in all other regions except North America. Global deliveries were down from last year because of continued lower market demand and reduction of inventories at the dealerships in Europe and North America, partly offset by increased deliveries for the SDLG brand in China.

Turbulent times

“We are living in turbulent times and, like other companies, are feeling the effects of a market slowdown,” said Melker Jernberg, head of Volvo CE. “But we are maintaining our leading position with a strong portfolio, the continued roll-out of new products and services and our steadfast commitment to the industry transformation.

“The ambitions we have set out towards building the world we want to live in remain unchanged and we take pride in working together to balance the priorities of today with our confident vision for tomorrow.”

Volvo CE continued the market launch of new and upgraded models of its most important products and services in key markets in Asia and North America. This included an updated range of the new generation excavator portfolio, as well as the anticipated L120 electric wheel loader.

The quarter also opened a new wheel loader facility in Arvika, Sweden, designed to support the production of electric wheel loaders at the plant. This is one of a number of global investments made to drive industry transformation across production facilities and markets worldwide.

Market development

Compared to 2023, the total machine market contracted in Q3, largely because of a slowdown in Europe – a 25-percent drop from the historically high levels of last year, driven by a combination of low business confidence and a saturated end market. As a consequence of normalizing replenishment of dealer fleets and somewhat lower end customer demand, North America also declined 9 percent from very high levels in 2023.

Meanwhile Asia excluding China was slightly down overall by just 2 percent, despite market growth in India, Indonesia and the Middle East, while markets such as Turkey experienced declines partly driven by revised government infrastructure investments.

In contrast, the Chinese market grew 5 percent on the back of governmental policies to stimulate the real estate market, while good demand in Brazil, Peru and Chile brought a similar 5 percent increase in market development for South America.

About the Author

Michael Roth

Editor

Michael Roth has covered the equipment rental industry full time for RER since 1989 and has served as the magazine’s editor in chief since 1994. He has nearly 30 years experience as a professional journalist. Roth has visited hundreds of rental centers and industry manufacturers, written hundreds of feature stories for RER and thousands of news stories for the magazine and its electronic newsletter RER Reports. Roth has interviewed leading executives for most of the industry’s largest rental companies and manufacturers as well as hundreds of smaller independent companies. He has visited with and reported on rental companies and manufacturers in Europe, Central America and Asia as well as Mexico, Canada and the United States. Roth was co-founder of RER Reports, the industry’s first weekly newsletter, which began as a fax newsletter in 1996, and later became an online newsletter. Roth has spoken at conventions sponsored by the American Rental Association, Associated Equipment Distributors, California Rental Association and other industry events and has spoken before industry groups in several countries. He lives and works in Los Angeles when he’s not traveling to cover industry events.