June 5, 2013, was a great day for Don Ahern and Ahern Rentals. After an 18-month process, the company received confirmation that its reorganization plan had been approved by the bankruptcy court. It meant a new beginning for the United States’ largest family-owned equipment rental company.

What nobody knew at the time was that it also would mean a new beginning for one of the world’s oldest aerial work platform manufacturers, Snorkel, which had been put up for sale several months earlier by its U.K.-based parent company, Tanfield Group plc. Snorkel had fallen on lean times since the recession hit in 2008 and was having difficulty supplying some of its key markets with machines as well as providing parts and service. The new owner of Snorkel would be required to invest significant capital to get the manufacturer, with U.S. headquarters in Elwood, Kan., producing machines, rebuilding its parts and service capability and back into a growth mode.

As the owner of nearly 800 Snorkel boomlifts in Ahern Rentals’ rental fleet, Ahern was concerned about his investment in Snorkel machines. Although Ahern Rentals and Ahern’s forklift manufacturing company Xtreme Forklifts could, if necessary, manufacture hard-to-obtain parts, the lack of parts and service was making the value of Snorkel machines plunge on the resale market. Nobody would pay much for a machine for which parts and service was virtually unavailable. Ahern had an interest in protecting his investment.

But it was more than that that made Ahern interested in possibly buying Snorkel and providing it with a needed injection of capital. He had genuinely always been an admirer of Snorkel machines and although they were only a small portion of his 21,000-unit aerial fleet, to him they filled an important niche and were much admired by a number of his customers.

One of the first suggestions came in a conversation with a Snorkel sales rep.

“He said, ‘Don, you’re the one who ought to buy Snorkel,’” Ahern says. “He said, ‘You know equipment, you know manufacturing. You could make it work.’”

It wasn’t the first time Ahern had thought about acquiring Snorkel. The aerial work platform line lay dormant in 2002 until a group led by Kansas businessman Al Havlin acquired it and got it working again, resuming manufacturing in early 2003. Ahern had taken a look at possibly joining one of the two ownership groups that were competing to acquire the line and bring it back to life. However, the possibility of being a part owner did not work out for Ahern at that time.

This time, when Tanfield began looking for a buyer, Ahern had other more pressing concerns, primarily working out a deal to pay back bondholders and bring Ahern Rentals out of bankruptcy. However, Enoch Stiff, a member of Ahern Rentals’ board of directors and former CEO of Omniquip, which owned Snorkel from about 1996 through 2000, began exploratory talks with Tanfield management at the Bauma show in Munich in April of last year about a possible acquisition deal.

This time around, Ahern had a lot more to offer and also had become a major player in the manufacture of high-end telescopic handlers with his company Xtreme Forklifts. The stars were beginning to align and momentum towards a deal accelerated with Ahern Rentals’ emergence from bankruptcy in June.

Xtreme’s telehandlers, which go as high as 70 feet, are manufactured with high-grade steel and have more functionality and are priced higher than those typically found in the rental industry. Xtreme makes high-pivot telehandlers, a 40,000-pound capacity machine, and a number of specialty units. Its warranties guarantee the frame and chassis for 10 years, the roller boom for five years, and the engine, transmission and drive axel assembly for two years. Not many rental companies buy them because rental machines typically don’t require the more sophisticated levels of manufacturing and higher prices Xtreme offers, not to mention the fact that Ahern doesn’t like selling them to rental companies that compete with Ahern Rentals, not wanting to compete with his own machines. Xtreme forklifts are, however, staples of Ahern Rentals rental fleets. Xtreme produced more than $62 million worth of products in 2013.

The synergies between Xtreme and Snorkel are impressive. Snorkel, long a respected manufacturer of boomlifts and scissorlifts, does not make telehandlers. Now not only will Snorkel be able to offer the high-end telehandlers made by Xtreme, but Xtreme will begin making more of a standard-quality machine typical of those used in the rental market for Snorkel to market for its rental customers.

A benefit for Xtreme is access to international distribution, something it previously lacked. Snorkel has access to international markets, with manufacturing facilities in England, Australia and China, and 75 international distributors outside the United States.

“We’re talking, for example, a major market share of the mining industry in Australia,” says Stiff. “And when you go to the higher end of the Xtreme line, the single biggest customer is mining and oil and gas. So all of a sudden the opportunity for the high-end Xtreme machines to go through a dealer network, not only a dealer network but company-owned stores, that’s a lot of synergy. Also South Africa, China, all the other places where mining is important, or even some of the big construction areas like the Middle East, all of that now gets opened up to Xtreme.”

Another synergy is Ahern Rentals’ parts capability, an area that Snorkel has fallen down on in recent years.

“In areas like parts, Don has one of the most advanced parts systems in the industry supporting Ahern Rentals,” says Stiff. “Now the opportunity to support Snorkel parts, which was its biggest weakness, becomes its biggest strength. Don has a large Snorkel fleet already. And one of the things that he was concerned about was that the used equipment market was treating Snorkel very badly. And that is a huge asset value to the fleet. There was no support so there was no after-market. It’s that simple. Now all of a sudden you get world-class support, so the value of the equipment has to go back up to its normal pricing level. That takes a very large part of Don’s fleet and brings it back up to good market pricing. So you put that in to the pricing on the deal, you have to realize that’s just a natural synergistic effect of getting the deal done.”

There are also synergies on the manufacturing end. “Xtreme is currently fabricating for Snorkel, we have 93,000 square feet of fabrication capacity in Southern California,” says Ahern. “Xtreme is doing all the prototypes of the booms. Xtreme has a strong skill-set in building booms and the welding of booms. That’s not only technology, it’s an art. One of the things I’m going to continue to do is try to build all the boom tubes at Xtreme.”

Xtreme Forklifts will also be building a telehandler for Snorkel that will not include many of the high-end costly features and benefits of other Xtreme units. The Xtreme reach machines generally cost 10- or 15-percent more than others in the business, with longer warranty, more costly componentry and more expensive designs.

“The machine Xtreme is building for Snorkel will have more of the standard features like a JLG or Skyjack,” says Ahern. “We call the project a standard reach machine, more of a standard model, priced right, designed for the independent rental company. We are going to reach out to independent rental companies of the U.S. and we’re going to build them a machine that’s priced right, works simply and will give them a competitive advantage. It is my hope that the independent rental guys across the United States will view me as an independent as well and we want to make friends with the independent rental companies. We want to help grow their businesses. This is not about Ahern Rentals.”

Spread-around spend

Will ownership of Snorkel make Ahern Rentals primarily a Snorkel house? Even if Ahern wanted it that way, it wouldn’t be possible. With close to 800 Snorkel machines in Ahern Rentals’ fleet, Ahern is one of Snorkel’s largest customers, but Snorkels make up only a small portion of its total fleet.

“We will still buy Skyjack and JLG and Genie at Ahern Rentals, and we’ll buy some Snorkel as well,” says Ahern. “Generally JLG gets close to half of my spend. Skyjack gets about a quarter, Genie gets a quarter. Those are not exact percentages, but about. I bought 900 booms from JLG and Genie in 2013, more than 1,000 scissors from Skyjack. I’ve got over 800 Skyjack scissors on order right now. So we’ll continue to spread it around because I think that’s the right thing for Ahern Rentals.”

Ahern adds that different customers prefer different machines, there are regional preferences and applications with varying requirements. And obviously Snorkel at this point could not satisfy the requirements of the thousands of machines Ahern Rentals needs in its far-flung rental fleet. Besides, Ahern says, Snorkel will have to earn the business.

“If Snorkel performs and deserves Ahern Rentals’ business, it will get it,” Ahern says. “I’m not giving my business to Snorkel just because I own it; it’s going to have to earn it, just like it does with all its customers. We’ve got two orders with Snorkel now. If Snorkel continues to improve its offering and its product, it might get more. There are 48 models that Snorkel offers, more than almost any AWP manufacturer. They offer, for example, the pop-up little scissors, the push-arounds, they have more models there. They have about five different models of trailer-mounted, more than anybody else.”

Six months on the road

Obviously it’s very unlikely Xtreme Forklifts would have acquired Snorkel if Ahern Rentals was still in bankruptcy, although Ahern makes it quite clear that Xtreme and Ahern Rentals are separate businesses, and that manufacturing and the rental business are also completely separate.

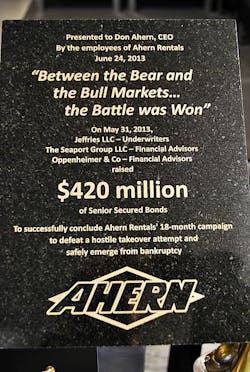

Ahern points out that Ahern Rentals was never really bankrupt in the sense of being unable to pay its bills. “I’m really proud of the fact that we paid everybody 100 cents on the dollar,” says Ahern. “I’ve never gone through life and not paid my bills. Typically at any time we have about $24 million of accounts payable at Ahern Rentals. That’s kind of a rolling average, about $24 million. When we filed bankruptcy we had $3 million. We paid every bill we could find and we paid it before we filed. And when we filed, we had $51 million in liquidity on our credit line. The only reason that we filed was to stop the hostile takeover.

“I had $51 million in credit line at the time we filed. [Our creditors] could try to do a hostile takeover because half of my debt was public. They bought public debt, and then wouldn’t accept payments after it was due because of the downturn and the condition of the credit markets. We couldn’t issue new bonds. So once we recovered, we issued new bonds.”

Ahern’s strategy for emerging from bankruptcy – and paying off all creditors 100 cents on the dollar – was to expand across the country. The strategy was developed by Ahern along with board members Stiff and Mark Wattles, founder of the Hollywood Video film rental chain. Rather than sell off excess fleet, as most rental companies were doing at a time when used equipment markets were down, he chose to deploy it across the country, opening 35 new branches, a massive undertaking strongly criticized by competitors. As the economy improved and the company’s EBITDA grew, the EBITDA-to-debt ratio became more favorable to the point that the company was able to get the funding it need to pay back its creditors in full.

Ahern’s son Evan Ahern, president of Ahern Rentals, played the leading role in setting up the new branches across the country. Evan spent literally three years on the road along with his wife and four daughters. At one point the family was on the road for six months without going home.

At the time, Evan and his wife were home-schooling their four daughters – now ages 10, 10 (twins), 13 and 15 – with the help of hired instructors. But for that six-month period, the Ahern daughters got a crash course in rental center management, at times helping out on the rental counter or in the parts department.

While it would seem finding managers and staff for 35 new branches would be an overwhelming task, during the recession it was not too difficult because so many people were being laid off.

“The industry was laying them off all over the place,” says Evan. “Some of the best people in the industry and they were the highest compensated were the ones that got shot first.”

Meanwhile, Ahern’s strategy was working. As his equipment spread out across the country, Ahern Rentals established footholds particularly in the South, Southeast and East Coast. The company’s EBITDA, which had plunged from almost 160 at its height, had dropped to a low of 46 early in the recession, was already recovering to about 75 when the bankruptcy petition was filed. By the time the company obtained its funding it was almost 125 and might have been higher had it not been for the expenses of expansion.

Now things are moving strongly for Ahern Rentals. It took in $381 million in total revenue in 2012, and while the numbers aren’t finalized for 2013, Ahern expects the company to top those numbers with the biggest year in the company’s history. Its new southern California headquarters in La Mirada is a shining example of the company’s new confidence and aggressiveness. The company took over an empty 105,000-square-foot warehouse and designed it into a rental facility.

There are sections for small tool and equipment repair, a scissors repair area, a boom repair, a forklift area, an earthmoving equipment area, a specialized oil-changing area, and an in-house truck repair department where the company services and repairs trucks from surrounding stores.

“It’s really a unique concept,” says branch manager Jerry Pires. ”Typically you see rental yards where it’s all outside and you have your inside shop space. This is all inside. We really tried to design everything with efficiency in mind. So that we’re not tripping over each other, we’re not running down each other.”

Ahern Rentals has also taken 200,000 square feet formerly part of Snorkel’s Elwood, Kan., facility to use as a remanufacturing facility for aerial equipment. Ahern Rentals now has three hubs of centralized operations for rebuilding equipment, Atlanta, Las Vegas and Elwood, Kan.

Snorkel moving forward

Things are moving forward strongly now for Snorkel. The company has dramatically rebuilt its parts backlog. Ahern says the company filled literally 10 times as many orders in December as in November. The three organizations combined – Ahern Rentals, Xtreme Forklifts and Snorkel – now have $35 million worth of parts available (close to a third of that for Snorkel), with several parts facilities, and is planning a new central parts facility in Las Vegas.

Ahern is putting a lot of energy into rebuilding Snorkel’s relationships.

“We had to go out and create new relationships with all the vendors,” says Ahern. “I had to go out and make sure the relationships with these companies were going to be able to continue. The battery company, various components suppliers and other suppliers. Trying to get them back up to speed, mend the relationships, pay the unpaid bills.”

The world of Don Ahern moves forward, miles every minute. There are new plans on the drawing board for Ahern Rentals, for Snorkel, for Xtreme Forklifts, three different companies that, incredibly, complement one another. He has his own plane – which he used to fly himself – and in any given day he’s in Las Vegas or California, in Kansas or the East Coast, in any of a number of places in the United States. This week he’s in the U.S., the next week he’s in Australia or China or the U.K., visiting distributors, suppliers, manufacturing facilities, unfathomably aware of thousands of details about each situation, each new plan and a level of knowledge of machinery that few can match. New facilities are being built, new factories, new machine designs, and somehow, amazingly, it all fits together.

And the sun never sets on Don Ahern’s world.