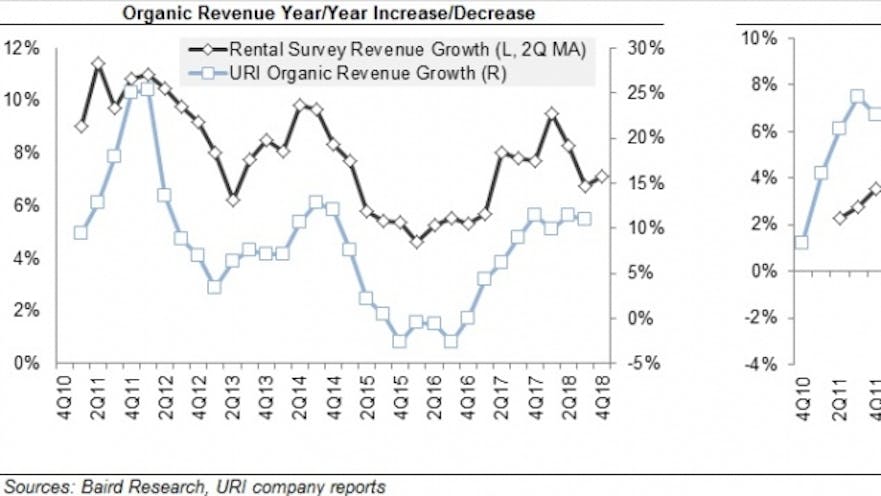

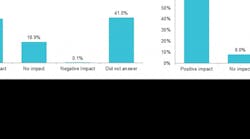

Rental equipment demand remained steady in the fourth quarter and growth is expected to continue in 2019 but likely at a slower rate, according to respondents to the Baird/RER 4Q18 Rental Equipment Survey. Rental rates growth remained stable at 2.3 percent, although multiple smaller respondents mentioned increased competitive pressures.

Anecdotal commentary noted continued strong end-market demand with growth expected to continue, but likely at a more moderate rate in 2019. Weak oil prices pose a risk going forward in 2019, but negative effects have not been felt yet. Fleet growth and rising equipment prices, with costs of steel and Tier 4 equipment being major causes, pose a challenge for striking the right pricing balance. This is not new, Baird economists note, but arguably more difficult than in the past.

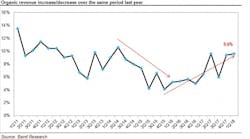

Average rental revenue growth was 7.7 percent year over year in the fourth quarter of 2018, compared to 6.5 percent in the third quarter of 2018. Average rental rates jumped 2.3 percent year over year in the fourth quarter, up slightly from a 2.2-percent rise in the third quarter. Increased fleet sizes appear to be driving heightened competitive pressures and suppressing rental rate growth, especially for smaller rental companies.

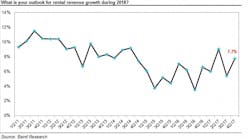

Respondents expect an average 6.2 percent revenue growth in 2019, below average actual growth from the four 2018 surveys. Respondents expect a 4.2-percent increase in fleet purchases during 2019. Respondents expect to increase earthmoving equipment 4 percent, but they only expect to grow their access fleets by 1 percent.

Respondents only expect rental rates to increase 1.7 percent in 2019, showing a more cautious expectation than respondents expected for 2018.

End-market demand commentary was mostly positive, although a handful of participants mentioned perceptions of peak demand conditions. 2019 growth expectation was somewhat below 2018 growth, with respondents expecting revenue to increase 6.2 percent, compared to the 7.7-percent actual growth among respondents in 2018.

Fleet utilization in the fourth quarter was between 63 and 66 percent for the sixth consecutive quarter, coming in at 63.6 percent, down 210 basis points sequentially and 130 basis points year over year.

The utilization rate for access equipment dropped to 64.7 percent from 72.4 percent in the fourth quarter of 2017, while the utilization rate for earthmoving equipment dropped to 57.3 percent from 65.6 percent in Q417, mostly offset by high utilization rates for “small iron” and “other”.

Growth in the cost of new units increased 3.9 percent, below the third quarter’s 4.6-percent gain, but still towards the higher end of the three-year range. The increase is consistent with multiple OEM’s price-increase announcements in late 2017 and 2018, driven by heightened raw material inflation and tariffs. The average fleet size in units grew 5.4 percent year over year in the fourth quarter. Multiple respondents mentioned lengthening lead times and higher equipment prices.

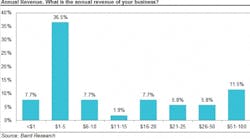

A solid 55 percent of respondents expected continued solid growth for construction activity, with 44 percent expecting slower growth. Twenty-seven percent of respondents expected continued solid growth for oil and gas activity, with 30 percent expecting slower growth. Based on end-market growth expectations, 49 percent expect higher fleet investment in 2019, 20 percent expecting materially higher, and 29 percent expecting modest increase. 32 percent expect flattish spending and 19 percent expect lower spending.