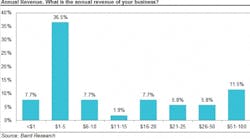

Business in the first quarter of 2019 was slower than expected in many parts of the United States because of adverse weather in the late winter and early spring, according to the Baird/RER first quarter research survey of rental companies. Revenue growth and utilization dropped significantly on a sequential basis. However, the outlook for 2019 in terms of revenue growth, rate growth and fleet spending all improved from last quarter’s 2019 outlook, pointing toward expectations for pent-up rental demand once the weather improves.

Anecdotal commentary noted continued strong end-market demand with growth expected to continue in 2019, but likely at a more moderate rate.

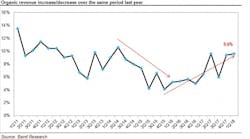

The average rental revenue growth was 5 percent year over year in the first quarter, compared to a 7.7-percent growth rate recorded in the fourth quarter of 2018 (on a year-over-year basis). Average rental rates increased 1.8 percent year over year in the first quarter, compared to a 2.3-percent rental rate growth rate in December 2018. Increased fleet sizes are driving heightened competitive pressures while suppressing rental rate growth, especially for smaller rental companies.

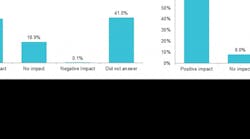

Fleet utilization dropped 750 basis points sequentially, and 910 basis points year over year to 56.1 percent. The drop in utilization was unusually high. Challenging winter weather clearly played a role in the drop, but the size of the decline could point to other contributing factors.

Growth in the cost of new units increased 2.8 percent, down from last quarter’s 3.9-percent increase, and the previous quarter’s 4.6-percent hike, leading Baird analysts to comment that OEM price increases and steel surcharges appear to be normalizing.

Despite the slow start, survey forecasts appear to be incrementally positive. Respondents expect an average of 8.3 percent revenue growth, higher than last quarter’s 6.2 percent forecast for 2019.

Respondents expect to increase fleet purchases by an average of 4.8 percent in 2019, up from a 4.2-percent expectation last quarter. Respondents expect to increase earthmoving equipment expenditures by 4, and access equipment expenditures by 1 percent. Respondents expect rental rates to increase 2.2 percent in 2019. Respondents expect higher replacement demand for earthmoving equipment by 61 percent, and 65 percent higher replacement demand for access equipment. Fifty-one percent report that their average fleet age is younger than two to three years ago, while 25 percent have an older fleet.