I have been asked this question by rental company executives, private equity firms, industry analysts, magazine publishers and investors. The top five rental companies claim it is market share; yet can five companies be gaining while nobody loses share?

There is a market share shift for the well-financed, larger rental companies that are taking share from the smaller rental companies. These larger companies are able to invest more in buying equipment to grow their fleet while the smaller rental companies are without a source of capital. What we are seeing today is that the original equipment cost of the larger rental companies are at all-time highs, time utilization is at record levels, pricing is strong and revenue is pouring in.

But it is not just that larger rental companies are taking market share from smaller rental companies because many – not all, but some -- smaller and mid-sized rental companies are doing just fine and also are increasing their revenue. The truth is that now that the industry is emerging from its recession, rental industry total revenue is growing once again and will, most likely, continue to do so in the coming years.

Rental industry revenue is growing at a faster pace than the construction industry, which is, for the most part, flat. So the growth of the rental industry is the result of greater rental penetration.

There are six major factors that are fueling the movement from ownership to rental, and thus fueling the growth we see of rental in North America.

- Improved customer service.

- Improved asset utilization, reduced storage and maintenance.

- Avoidance of capital outlay.

- Reduced obsolescence.

- Wider range of modern, productive equipment in rental fleets.

- Rental is the preferred option during economic downturn.

Let’s take a look at how these factors contribute to the growth of rental in North America.

Improved Customer Service

Let us begin with improved customer service. In the early 1980s, if you put a piece of equipment on rent you often hoped it would operate or “make the rent.” It wasn’t uncommon for a rental company to supply an extra piece of equipment at the jobsite, just in case the customer experienced an equipment performance problem. Today a rental company would rarely consider doing that, because equipment is maintained at a much higher level, and most rental companies follow recommended service intervals as recommended by manufacturers and keep computerized service records.

The level of service offered by the largest rental companies is unprecedented. On-time delivery, scheduled pickup, accuracy in invoicing, quality equipment and excellent response time in case of a mechanical problem should one occur, are becoming the standards of the business coupled with competitive rental rates. Contractors often find it difficult for the equipment they own to match the performance of the rented piece of equipment.

Improved Asset Utilization, Reduced Storage and Maintenance Costs

The level of asset utilization is far higher for rental companies than it was 20 or so years ago. Contractors are finding they are significantly reducing their equipment storage and maintenance costs by substituting rental for ownership. The story is not new, but the increased dependence on rental is.

Avoidance of Capital Outlay

Rental enables the equipment user to avoid capital outlays and enjoy a clean balance sheet by substituting a rented piece of equipment for the costs of owning equipment. Many contractors and industrial companies are selling off their fleets of equipment and are renting much more than in the past. When awarded a new job, the contractor often plans budgets to rent equipment rather than acquire it and can do so with confidence that the rental company will provide well-maintained, relatively new equipment.

Reduced Obsolescence

The fact that a rental company can provide relatively new equipment is a great advantage for contractors that cannot buy new equipment frequently. Today, rental fleet ages are dramatically down, ranging from 36 months to the low 40s. Contractors do not have to burden themselves with older, less productive equipment. Therefore, contractors are far more productive because they are using more up-to-date, more modern and efficient equipment.

Wider Range of Modern, Productive Equipment in Rental Fleets

When I came into the rental business in 1982, if a contractor wanted a light tower, large generator or hydraulic excavator, he had to buy it. Rental companies did not offer such equipment. Contrast that to today when the rental industry’s largest fleet has a $7.3 billion original equipment cost. The fleet offerings are wide-ranging and are offered across North America. The geographic coverage of the larger rental companies ranges up to 900 branches. When I joined Hertz in 1982, we had 55 locations nationwide and Hertz Equipment Rental Corp. was the largest rental company in the U.S.

Rental is Preferred Option During Economic Downturn

Economic uncertainty, in my opinion, is the single most significant factor fueling rental revenue growth. I find it interesting that as a macro indicator forecasts concern, the share price of the publically traded rental companies takes a hit. But in reality, the reverse should occur. I am starting to believe that the more a macro economic indicator indicates a slowing in the recovery, the better it is for the rental companies. I believe that these macro indicators are driving contractors to sell off their fleets and turn to rental. Many contractors and commercial companies are relying solely on rental and are not purchasing equipment.

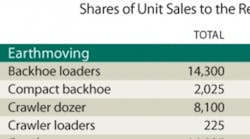

Yengst Associates’ study of who is acquiring construction equipment in 2011 indicates the rental industry is the biggest buyer.

Yengst Associates Market Machinery Research Rental Industry June 2012

Where is the revenue coming from? The growth of rental is coming from rental penetration!

For years I have been the quoted source for rental penetration. My estimates were not necessarily based on analytical data, but more on a feel for the business, based on many conversations with manufacturers, rental companies, research firms, associations and others in the industry.

Reliable data on penetration is hard to come by. A recent industry analysis on the rental equipment industry by Yengst Associates puts the figure at nearly 55 percent though it varies widely by asset class. Aerial equipment has long been an asset owned by rental companies as opposed to contractors and others. But now the shift is also occurring for earthmoving equipment.

Will that penetration figure go as high as 80 percent as is the case in the United Kingdom or Japan? Probably not. But rental will remain attractive even after the construction end markets recover in North America, and rental penetration still has significant room for growth. Once customers have used rental, they generally make it permanent. The challenge for the rental companies is to seize this opportunity and to make the most of it by continually improving levels of service and showing contractors that try rental that they have made the right choice. rer

Percentage of Rental Penetration Continue to Rise in North America

Daniel Kaplan is the former CEO of Hertz Equipment Rental Corp. and is currently CEO of Daniel Kaplan Associates, West Orange, N.J.