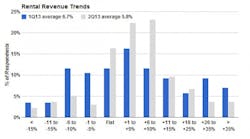

Poor weather in the Midwest and Northeast regions of North America delayed the start of the normal spring construction season, resulting in a 5.8-percent year-over-year rental revenue decline in the second quarter of 2013, the latest 2013 Baird/RER rental equipment survey showed. This was a decline from last quarter’s 6.7-percent year-over-year rental revenue increase. Average rental revenue increased more for big iron equipment in the second quarter with a 6.2-percent leap, showing more steady growth.

The strongest end markets, according to the quarterly survey, were residential, described as “rebounding”; some manufacturing; transportation; events; and a mixed oil and gas market. The weakest markets were public, some manufacturing and power/electric.

“Most contractors are saying they are really busy and can’t even catch up on the work they do have,” one survey respondent said. “[There is] some construction, but not yet enough to sustain overall industry fleet buildup,” said another.

Rental rates increased 2.2 percent year over year, an improvement from 1.0 percent in the first quarter of the year. In general, respondents are seeing improved demand, but not at a level sufficient enough to drive meaningful rate growth. Respondents, however, expect rates to move higher in the second half of 2013.

“We have been fortunate to maintain our published rates on equipment — not much discounting, if any,” one survey respondent said.

“Rates continue to be competitive,” another respondent noted. “Fleet age in national rental companies is increasing.”

Utilization rates in the second quarter were relatively flat sequentially at 55.6 percent in Q213 compared to 59.7 percent in the first quarter. “We believe the industry can support utilization rates in the 70 to 80-percent range, with excess capacity in a slowly rebounding construction market leading to rental rate choppiness,” said Baird facility & industrial services senior analyst Andrew Wittmann.

“[There is] more unit utilization across the spectrum,” a respondent said. “Our customers are keeping equipment longer than last year. Last year they seemed to only have the equipment long enough to finish their jobs.”

Sales of used equipment in the quarter increased 4.1 percent year over year, a decline from prior highs of 5.9-percent growth in Q212 and 8.8-percent growth in Q113.

“More equipment rentals, less equipment purchases,” relayed a survey respondent.

Average fleet size grew 2.3 percent in the second quarter from the same period a year ago. Survey respondents expect growth to continue to moderate as utilization rates remain relatively soft. “Notably, growth in cost of new units — 5.9 percent year over year — moderated compared to last year, likely owed to timing of Tier 4 engine introductions,” Wittmann said.

Respondents now expect about 6.6-percent revenue growth in 2013, relatively consistent with year-to-date performance. “This forecast has changed little all year,” said Wittmann. “Outlooks vary considerably depending on end market and geographic exposure, with South and West being strongest.”

“[There is] lots of interest and more customers are showing signs of returning to normal, however, there are still quite a few customers that are slow,” one survey respondent said.

“The Obama declaration to push emission controls and regulation by use of the EPA creates an atmosphere of instability for the small rental companies like ours,” another respondent said.

Planned fleet spending over the next six months continues to decline, the Baird/RER survey shows, as respondents see a 2.8-percent year over year increase in fleet spending versus 4.2-percent growth last quarter. “Importantly, the moderation is primarily owed to respondents in the “other” category, as big iron expects a 4.3-percent increase in fleet spending, while small iron expects a 4.8-percent increase,” said Wittmann.

Participants in the Baird/RER survey are senior executives at rental equipment companies or senior managers at regional divisions of rental equipment businesses in all regions of the United States, parts of Canada and some international markets. Forty-nine percent of participants’ rental businesses generate annual revenue of less than $5 million, with 65 percent generating annual revenue of less than $15 million. Rental companies generating more than $100 million in annual revenue represent 13 percent of the respondents.

Robert W. Baird & Co. is an employee-owned, international wealth management, capital markets, private equity and asset management firm with offices in the United States, Europe and Asia. For more information, visit Baird’s website at rwbaird.com.

RER has covered the equipment rental industry since 1957, providing its readers with a mix of news, features and product information. For more information, visit www.rermag.com. To let us know about any additional information you would like measured by the Baird/RER survey, post your comments on our Facebook page at www.facebook.com/pages/Rental-Equipment-Register or email RER editor Michael Roth at [email protected] or RER managing editor Brandey Smith at [email protected].