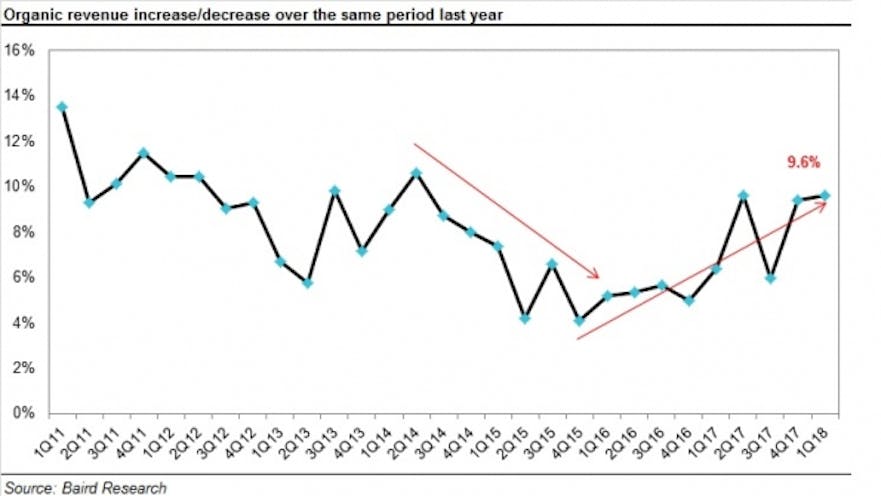

The average rental revenue growth of 9.6 percent year over year in the first quarter was slightly higher than last quarter’s 9.4 percent and equal to 2Q17’s growth of 9.6 percent, according to respondents to the Q1 Baird/RER Equipment survey. The 9.6 percent was the survey’s strongest growth rate since 2014. After declining from 10.6 percent in the second quarter of 2014 to 4.1 percent in the fourth quarter of 2015 (mainly attributed to commodity-related weakness), rental revenue growth has been improving steadily for the past two-plus years.

Growth in 2018 is expected to remain robust, survey respondents said, with respondents expecting revenue to increase 9.5 percent in 2018.

“Contractors are busy and rental demand is much stronger than 1Q7,” said one respondent. “Earthmoving, access equipment, other equipment utilization is increasing.”

“Strong growth across sectors,” said another. “Continued confidence that the economy will remain strong.”

Average rental rates growth were up 3.8 percent year over year, similar to growth rates prior to the commodity downturn during 2015-2016, respondents said. Smaller respondents highlighted pricing competition from larger firms, but said pricing pressure lowered as demand improved. Rental rates are expected to jump 4.8 percent in 2018, respondents said, up from last quarter.

Fleet utilization was the highest in survey history for the third consecutive quarter at 65.3 percent, compared to 64.9 percent last quarter and 53.5 percent in the first quarter of 2017. The utilization rate for access equipment, which accounted for 39 percent of the survey’s revenue, increased to 69.4 percent from 57.5 percent in the first quarter of 2017. The utilization rate for earthmoving equipment, which was 41 percent of survey revenue, increased to 66.5 percent compared to 55.2 percent in the fourth quarter of 2016.

Growth in the cost of new units increased 4.1 percent, up from last quarter’s 3.7-percent gain. The majority of respondents are expecting additional equipment price jumps because of tariffs and higher steel costs. Respondents reporting higher revenues were more likely to expect equipment price increases. Baird analysts think the discrepancy is owed to equipment mix as well as the fact that larger players tend to be in closer contact with OEMs.

“I think the impending trade wars are making customers look at used vs. buying new,” said one respondent.

The average fleet size of respondents grew 7.3 percent year over year in the first quarter of 2018, compared to last quarter’s 5.2-percent growth. Several respondents mentioned concern over lengthening lead times. Respondents expect a 6.6 percent increase in fleet purchases in 2018, compared to 7.4 percent from 4Q17 respondents.

“The long lead times for equipment are a big challenge that limits our ability to adjust,” said one respondent.

“2009, 2010, and 2011 are still too fresh in my mind to extend our company like we did in 2008,” added another.

The Baird analysis is that rental industry trends remain healthy with revenue up an average of 9 percent the past four quarters, utilization reaching a record high three quarters in a row and rental rate growth at a multi-year high. Anecdotal commentary remains positive although multiple respondents sense that key end markets may be approaching cyclical peaks. Equipment OEMs are benefiting from increased demand, but multiple price/cost headwinds could impact OEM margins and pressure estimates.