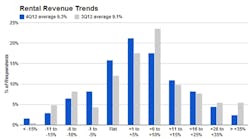

The fourth-quarter 2012 Baird/RER rental equipment survey continued to show revenue growth in the industry, marking a 9.3-percent year over year increase, and improving modestly from the 9.1-percent year over year third-quarter 2012 increase. Revenue trends remain solid and relatively unchanged from Q312. The updated 2013 outlook reflects expectations for continued high-single-digit growth, with pricing expected to remain a tailwind.

“While it slowed through December, it appears that everyone has plenty of work and projects to kick off,” one respondent said. “We are seeing more commercial construction activity, as well as improving multi-family,” said another. “[It was a] sluggish end of the year with bright spots within certain markets. Early indications for growth are very positive.”

Fourth-quarter rental rates increased by 2.3 percent from the same period in 2011, moderating versus the 3.2-percent year-over-year increase seen in the third quarter of 2012. Strong underlying demand and higher equipment costs continue to drive rental rates higher, though competition from the large national rental companies appears to remain elevated, according to the Baird survey.

“We have been fortunate to maintain our published rates on equipment with not much discounting, if any,” one respondent said. “Rental fleets are still adjusting fleet mix, which is causing fluctuations in selling price,” noted another. “Rates are very competitive as markets start to come back.”

In the fourth quarter, normal time utilization rates moderated to 56.5 percent versus 60 percent in Q312, consistent with typical seasonal patterns. Average utilization for big iron equipment was 62.2 percent, small iron was 47.7 percent and other was 54.7 percent. Higher overall utilization rates appear to reflect stable underlying demand, though some participants noted somewhat varied trends.

“Rental utilization is strong, but it is off from the record utilization we had last fall,” said one survey respondent. “For this time of the year, we are seeing strong quoting activity as well as higher-than-normal on-rent numbers,” reported another.

Used equipment sales grew 9.3 percent year over year during Q412 versus 4.6 percent year over year in the prior quarter, consistent with typical seasonal trends. According to the survey, continued strength in rental equipment appears to provide support for the used equipment market. “Year-end used equipment sales were up meaningfully over last year’s record numbers,” a respondent noted.

In their updated outlook for 2013 revenue growth, participants’ forecast a 7.5-percent increase in year-over-year revenue growth, modestly below the previous 8.5-percent outlook, likely reflecting some conservatism and difficult 2012 comparisons.

Consistent with recent trends, respondents’ outlooks varied by end market and geography: “The election is behind us and the fiscal cliff is not as big of a concern any longer,” one respondent said. “Residential construction is coming back and the general outlook is the best it has been in seven years.”

“There is a tremendous amount of work on the horizon,” said another survey participant. “However, it seems it keeps pushing to later dates.”

The revised outlook for 2013 rental rates shows that respondents expect levels to increase by 3.1 percent year over year, implying moderate improvement on a year-over-year basis from current-quarter levels of 2.3 percent growth over Q411. While some pressure on rates from the national rental companies is expected to persist, it appears that overall pricing trends should remain a tailwind throughout 2013 — encouraging given looming difficult comparisons, Baird said.

Participants in the Baird/RER survey are senior executives or senior managers at regional divisions of rental equipment businesses in all regions of the United States, parts of Canada and some international markets, representing nearly $10 billion in annual revenue.

Robert W. Baird & Co. is an employee-owned, international wealth management, capital markets, private equity and asset management firm with offices in the United States, Europe and Asia. For more information, visit Baird’s website at rwbaird.com.

RER has covered the equipment rental industry since 1957, providing its readers with a mix of news, features and product information. For more information, visit www.rermag.com. To let us know about any additional information you would like measured by the Baird/RER survey, post your comments on our Facebook page at www.facebook.com/pages/Rental-Equipment-Register or email RER editor Michael Roth at [email protected] or RER managing editor Brandey Smith at [email protected].