Despite what we hear about the state of the global economy, its uncertainty and the lack of stability in most markets will continue driving growth in the rental industry in 2012.

Today's economic landscape is fraught with uncertainty making forecasting 2012 very difficult, but that's my job so here we go. United States GDP figures for the first and second quarter of 2011 were revised down and barely remained in positive territory. Although third-quarter GDP came in up at 2.5 percent, these figures are almost always subject to revisions. This year the stock market moved up and down 100, even 200 or more points, sometimes on a daily basis. People stopped reading their 401K statements. Then October brought a European banking crisis solution that resulted in the best October stock market performance in 25 years. In November, another European banking crisis wiped out those gains, but the market was quick to recover by early December and the stock market ended the year almost completely flat compared with the beginning of the year.

Whew! How do you make a forecast in an economic environment that looks good one day and bad the next? Filtering out the noise and focusing on economic signals is key.

Traditionally, construction equipment markets are highly correlated to housing starts. Housing is an important driver of demand for machinery rentals. It is a demand multiplier. When houses are built so are roads, sewers, water lines, power lines, schools, strip malls, hospitals and so forth. The 2011 increase in equipment rental demand has been a big surprise because none of the traditional demand drivers are up at all. In fact, 2011 annualized housing starts flat-lined at slightly more than 600,000 units, the lowest quantity since the 1940s. The amount of money spent on housing is actually down about 6 percent of GDP. Other construction segments have been important in the past as well as heavy construction and non-residential construction. Non-residential construction, which usually benefits rental companies, ended the year down about 5 percent. Heavy construction activity was slow as well, down about 1 percent compared with 2010.

It's hard to imagine that the economic turmoil the world is going through would be good for anyone, but it is. It has been very good indeed for the equipment rental industry. The economic uncertainty and the lack of visibility of only three to six months into the future is causing equipment users to chose to rent rather than buy equipment for the little bit of activity there is out there.

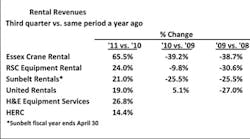

Revenues of the major rental companies were up through the third quarter and there is every expectation the trend will continue in the fourth quarter and well into 2012. Below is our comparison of several of the publicly traded rental companies' third quarters. Third-quarter 2011 rental revenues were up 65.5 percent at Essex Crane, on the high end — although that increase is partly the result of the addition of Coast Crane Rental — and up 14.4 percent at Hertz Equipment Rentals on the low end.

In my experience when utilization rates get this high two things happen. First, rental companies raise rental rates, which they have been doing aggressively. Rental rates improved considerably in 2011 with gains across the board from a low of a 4.5-percent increase to a high of a 13.3-percent increase at HERC. The public rental companies have all indicated they expect to raise 2012 rental rates in the mid-single digits.

Fleet utilization has been trending up all year. The six national rental companies that report earnings publicly indicated their fleet utilization rates are up, close to 70 percent overall. Rouse Asset Services reported in its December issue that utilization rates were 69.7 percent through September, their most recent data point.

In my experience when utilization rates get this high two things happen. First, rental companies raise rental rates, which they have been doing aggressively. Rental rates improved considerably in 2011 with gains across the board from a low of a 4.5-percent increase to a high of a 13.3-percent increase at HERC. The public rental companies have all indicated they expect to raise 2012 rental rates in the mid-single digits.

Second, they add to their fleet. Rental companies did not upgrade and add to their fleets in 2008, 2009 or 2010, which caused their fleets to age. Rouse estimates the average age of a machine is 51.3 months. I believe that rental companies will add fleet in 2012 in order to bring down the average machine age, but also because when utilization rates reach 70 percent or more rental companies start to lose rentals because they don't have enough fleet on hand. The following table is a tabulation of total fleet purchases of the 11 largest rental companies. It appears that 2012 total fleet purchases will reach the same high level as in the 2005/2006 period.

Along with higher fleet utilization and higher rental rates has come improved financial performance. The national rental companies all reported improved margins.

Where is the current rental demand coming from? I believe rentals are improving for three reasons.

-

Economic uncertainty makes renting a machine an attractive option compared with buying a machine.

-

New emission regulations (Tier 4 interim) are increasing equipment prices more than most equipment users expected. Equipment users are either renting or buying low-hour Tier 3 equipment.

-

Construction activity is coming from non-traditional markets such as shale gas exploration and surface mining activity both of which require large amounts of site-preparation and maintenance of the site once work begins.

Where do we go from here and what about 2012? I have found that construction employment is a good barometer of total rental activity. Construction unemployment has been coming down for the past year. At the end of 2010 construction unemployment was more than 21 percent; today it is about 13 percent. Of course 13 percent is still way above the national average, which was recently reported at 8.6 percent, but the 13 percent is a marked improvement nonetheless. I forecast that construction unemployment will decline gradually to less than 10 percent during the next 12 months. That implies that rentals will grow in 2012 to more than $28 billion, a growth rate of 12 percent compared with 2010, or about the same level the industry experienced in 2005. The 12 percent is a lower growth rate than the estimated 17-percent growth between 2010 and 2011 because of the lack of government stimulus programs and the slow growth I expect in all the other construction categories, especially housing.

My crystal ball is pretty dim beyond 2012 due to the uncertain global economy. The Euro-zone debt crisis, if unresolved, could negatively impact world economies. U.S. bank exposure to European debt is thought to be manageable, but the psychological impact for a Euro-zone meltdown would be far reaching. There is also the possibility of a significant slowdown of the China economy.

Although it may seem counterintuitive rental company owners should be heartened by all this uncertainty. The uncertainty will drive equipment users to use rentals more and more. It is very possible that my 2012 estimate of total rentals is too conservative. I believe there is more upside potential than downside risk. Furthermore it is possible for total rentals to return to their 2007 peak within two or three years. I think the future is bright for the U.S. equipment rental market.

Frank Manfredi is president of Mandelein, Ill.-based Manfredi & Associates, a marketing information firm that specializes in the construction, mining, farm and material-handling equipment industries. Visit www.machineryoutlook.com.