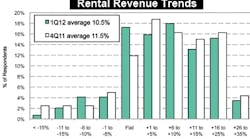

Baird, in partnership with RER, recently published results from its latest rental equipment industry survey highlighting the first quarter of 2012. The survey of more than 150 rental professionals showed continued double-digit rental revenue growth of 10.5 percent year over year, compared with 11.5 percent year over year in the fourth quarter of 2011. While trends remain varied based on geography and end market, overall trends show continued improvement.

“The market appears to be growing very quickly due to the oil & gas drilling sector,” one respondent noted.

“[We're] seeing more rental of equipment, with a continued reluctance on the part of contractors to purchase,” said another.

On average, respondents' rental rates increased by 3 percent year over year, consistent with the 3.8-percent increase reported in the fourth quarter of last year. While rate pressure from the national rental companies continues to be intense, those surveyed noted that the strength of underlying demand continues to push average prices higher.

“We are seeing greatly increased demand for all categories of equipment and positive rate improvement,” one participant said. “Rates are moving upwards — a slow, but steady, increase,” noted another.

Utilization rates remained healthy at 53.6 percent in the first quarter, seasonally lower than the reported 55.9 percent in 4Q11. Average utilization for big iron equipment was 60.4 percent in 1Q12, while small iron was 48.6 percent and other was 37.9 percent. The high utilization rates appear to reflect solid underlying demand and some fleet-availability issues, according to the report.

“We are seeing an increase in activity, with our typical customer's question being ‘Is it available?’ rather than ‘At what price?’” said one survey participant.

“We now have plenty of fleet and will focus on raising rates, which will probably sacrifice utilization,” said another.

In the first quarter, respondents reported that the number of units in their rental fleet increased by 6.3 percent year over year, down slightly from a 7.4-percent increase in the fourth quarter last year.

Respondents noted a 4-percent higher average cost for new units in the first quarter, a figure relatively unchanged from 3.9 percent in 4Q11.

Sales of used equipment in first-quarter 2012 were up 4.2 percent year over year, a more moderate improvement than the 8.4-percent increase in used equipment sales in the fourth quarter of 2011. “Continued strength in rental equipment appears to provide ongoing product support to the used equipment market,” Baird said.

In the updated outlook for 2012 revenue growth, respondents forecast a 12.2-percent year-over-year improvement, even more positive than the previous forecast in Q412 of 11.0 percent. In addition, the updated outlook for 2012 estimate for rental rates was an improvement of 3.4 percent year over year, a modest improvement from the estimate of 3.0 percent in the last 2012 rental rate forecast last quarter.

“Banks are loosening up a bit, commercial construction is coming out of the ground for those with the cash to build,” one respondent reported. “In the face of only minor increases in overall economic activity, we are cautiously optimistic about rental volumes,” said another.

In terms of fleet spending, respondents reported that they expect to increase spending on fleet by 9.2 percent over the next six months, up slightly from the expectation of 8.6-percent growth reported in the Q411 survey. In addition, the outlook for rental rates in the updated forecast estimates 2012 rates will increase 3.4 percent year over year, a slight improvement from the current-quarter level of 3 percent.

Participants in the Baird/RER survey are senior executives or senior managers at regional divisions of rental equipment businesses in all regions of the United States, parts of Canada and some international markets, representing nearly $9 billion in annual revenue. Of those companies surveyed, 45 percent generate annual revenue of less than $5 million, with 60 percent generating annual revenue of less than $15 million.

Robert W. Baird & Co. is an employee-owned, international wealth management, capital markets, private equity and asset management firm with offices in the United States, Europe and Asia. For more information, visit Baird's website at rwbaird.com.